Contents

- 1 Should I Claim Myself as a Dependent – Explained

- 1.1 Understanding Dependent Status

- 1.2 Factors to Consider

- 1.3 FAQ about topic Should I Claim Myself as a Dependent – Explained |

- 1.3.1 Can I claim myself as a dependent if I am over 18 years old?

- 1.3.2 What are the requirements for claiming myself as a dependent?

- 1.3.3 If I claim myself as a dependent, will it affect my parents’ ability to claim me as a dependent?

- 1.3.4 What are the benefits of claiming myself as a dependent?

- 1.3.5 What should I do if I am unsure whether I can claim myself as a dependent?

- 1.3.6 Can I claim myself as a dependent if I am over 18 years old?

- 1.3.7 If I am married, can I still claim myself as a dependent?

- 1.3.8 What are the benefits of claiming myself as a dependent?

Should I Claim Myself as a Dependent – Explained

When it comes to tax season, many individuals find themselves asking the question: “Should I claim myself as a dependent?” This is an important decision that can have significant implications on your tax return. To make an informed choice, it is crucial to understand the criteria for being considered a dependent and the potential benefits and drawbacks of claiming yourself.

Firstly, let’s clarify what it means to be a dependent. In general, a dependent is someone who relies on another person for financial support. This can include children, elderly parents, or individuals with disabilities. However, as an adult, you may also be considered a dependent if you meet certain criteria, such as being a full-time student or having a low income.

So, should you claim yourself as a dependent? The answer depends on your specific circumstances. If you financially support yourself and meet the criteria for being an independent taxpayer, it may be beneficial to claim yourself. By doing so, you can take advantage of certain tax deductions and credits that are only available to independent taxpayers.

However, claiming yourself as a dependent also means that you cannot be claimed as a dependent by someone else, such as your parents. This can have implications for both you and the person who would have claimed you. It is important to consider the potential impact on both parties before making a decision.

Ultimately, the decision to claim yourself as a dependent is a personal one that should be based on your individual circumstances. It is recommended to consult with a tax professional or use tax software to determine the best course of action for your specific situation. By understanding the criteria and potential benefits and drawbacks, you can make an informed choice and maximize your tax savings.

Understanding Dependent Status

As an individual, it is important to understand your dependent status when it comes to claiming yourself as a dependent on your taxes. The term “dependent” refers to someone who relies on another person for financial support. In this case, you are considering whether or not you can claim yourself as a dependent.

To determine if you can claim yourself as a dependent, you need to consider a few factors. First, you need to assess your financial situation. If you are financially independent and provide more than half of your own support, then you cannot be claimed as a dependent. However, if you rely on someone else for financial support, such as a parent or guardian, then you may qualify as a dependent.

Another factor to consider is your age. Generally, if you are under the age of 19, or under the age of 24 and a full-time student, you may be considered a dependent. However, there are exceptions to these age requirements, so it is important to review the specific guidelines set by the IRS.

It is also important to note that even if you meet the criteria to be claimed as a dependent, you have the option to not be claimed. This decision may impact your eligibility for certain tax benefits, so it is important to carefully consider your options.

In conclusion, understanding your dependent status is crucial when determining whether or not you can claim yourself as a dependent. Assessing your financial situation, age, and reviewing the IRS guidelines will help you make an informed decision. Remember, even if you qualify as a dependent, you have the choice to not be claimed.

What is a dependent?

A dependent is a person who relies on someone else for financial support. In the context of taxes, claiming someone as a dependent means that the person who provides the financial support can receive certain tax benefits.

When it comes to claiming myself as a dependent, it means that I am financially dependent on someone else, such as my parents or guardian. This could be because I am a student, unemployed, or have a low income.

Claiming myself as a dependent can have various implications for both me and the person claiming me. It may affect their tax return and potentially result in tax savings. However, it is important to understand the specific rules and requirements set by the tax authorities to determine if I qualify as a dependent.

Overall, the concept of being a dependent is based on the financial support I receive from someone else and the eligibility criteria set by the tax authorities. It is important to consult with a tax professional or refer to the official tax guidelines to determine if I can claim myself as a dependent.

| Key Points: |

|---|

| – A dependent is a person who relies on someone else for financial support. |

| – Claiming myself as a dependent means that I am financially dependent on someone else. |

| – It is important to understand the specific rules and requirements to determine if I qualify as a dependent. |

| – Consult with a tax professional or refer to the official tax guidelines for accurate information. |

Qualifications for claiming someone as a dependent

When determining whether you can claim someone as a dependent on your tax return, there are several qualifications that need to be met. These qualifications include:

- The person must be a dependent, meaning they rely on you for financial support.

- They must meet certain relationship requirements, such as being your child, stepchild, foster child, sibling, or a descendant of any of these.

- They must have lived with you for more than half of the year, unless they are a child of divorced or separated parents.

- They must be a U.S. citizen, resident alien, or national, or a resident of Canada or Mexico.

- They must not have filed a joint return with their spouse, unless it was only to claim a refund of taxes withheld.

- They must not have a gross income that exceeds the exemption amount for the tax year.

These qualifications are important to consider when determining whether you can claim someone as a dependent on your tax return. If you meet all of the qualifications, you may be able to claim yourself as a dependent and potentially receive certain tax benefits.

Consequences of claiming yourself as a dependent

When it comes to tax filing, claiming yourself as a dependent can have several consequences. Here are some things to consider:

- If you claim yourself as a dependent, you may not be eligible for certain tax credits or deductions that are available to individuals who are not claimed as dependents.

- Claiming yourself as a dependent may also affect your ability to qualify for certain government assistance programs or financial aid for education.

- If someone else can claim you as a dependent, they may be entitled to certain tax benefits, such as the Child Tax Credit or the Earned Income Tax Credit.

- Claiming yourself as a dependent may increase the likelihood of your tax return being audited by the IRS, as they may want to verify your eligibility to claim yourself.

- It’s important to note that claiming yourself as a dependent when you are not eligible to do so can result in penalties and fines.

Before deciding whether to claim yourself as a dependent, it’s recommended to consult with a tax professional or use tax software to determine the best course of action based on your specific circumstances.

Factors to Consider

When deciding whether to claim yourself as a dependent on your tax return, there are several factors you should take into consideration:

1. Financial Support: If you provide more than half of your own financial support, you may be eligible to claim yourself as a dependent. This includes expenses such as housing, food, education, and medical care.

2. Age: Generally, if you are under the age of 19 or a full-time student under the age of 24, you may be claimed as a dependent by your parents or guardians. However, if you are financially independent and provide more than half of your own support, you may be able to claim yourself.

3. Relationship: If you are married and file a joint tax return with your spouse, you cannot claim yourself as a dependent. However, if you are single or married but filing separately, you may be able to claim yourself.

4. Income: If your income exceeds a certain threshold, you may not be eligible to claim yourself as a dependent. The specific income limit varies each year and depends on your filing status.

5. Eligibility for Other Tax Benefits: If you claim yourself as a dependent, you may not be eligible for certain tax benefits, such as the Earned Income Tax Credit or the Child and Dependent Care Credit. Consider whether these benefits outweigh the potential tax savings of claiming yourself.

6. Consult a Tax Professional: If you are unsure about whether you should claim yourself as a dependent, it is recommended to consult a tax professional. They can provide personalized advice based on your specific financial situation.

Considering these factors can help you make an informed decision about whether to claim yourself as a dependent on your tax return. It is important to carefully evaluate your situation and understand the potential impact on your tax liability.

Financial independence

Being financially independent means that you are able to support yourself financially without relying on others for financial assistance. It is an important milestone in one’s life, as it signifies a level of self-sufficiency and freedom.

As a dependent, you rely on someone else, such as a parent or guardian, to provide financial support. However, as you grow older and become more responsible for your own expenses, you may consider claiming yourself as a dependent. This decision can have implications on your taxes and financial situation.

When you claim yourself as a dependent, you are stating that you are financially independent and do not rely on anyone else for support. This can have advantages, such as being eligible for certain tax deductions and credits. However, it also means that you are solely responsible for your own financial obligations, such as paying for your own healthcare and education expenses.

Before making the decision to claim yourself as a dependent, it is important to carefully consider your financial situation and responsibilities. Evaluate whether you have the means to support yourself financially and whether claiming yourself as a dependent will benefit you in terms of tax advantages and financial independence.

Ultimately, the decision to claim yourself as a dependent is a personal one that should be based on your individual circumstances and goals. It is important to consult with a financial advisor or tax professional to fully understand the implications and make an informed decision.

FAQ about topic Should I Claim Myself as a Dependent – Explained |

Can I claim myself as a dependent if I am over 18 years old?

No, if you are over 18 years old, you cannot claim yourself as a dependent on your tax return.

What are the requirements for claiming myself as a dependent?

To claim yourself as a dependent, you must meet certain criteria. You must be a U.S. citizen, resident alien, or national, and you must not be claimed as a dependent on someone else’s tax return. Additionally, you must provide more than half of your own support during the year.

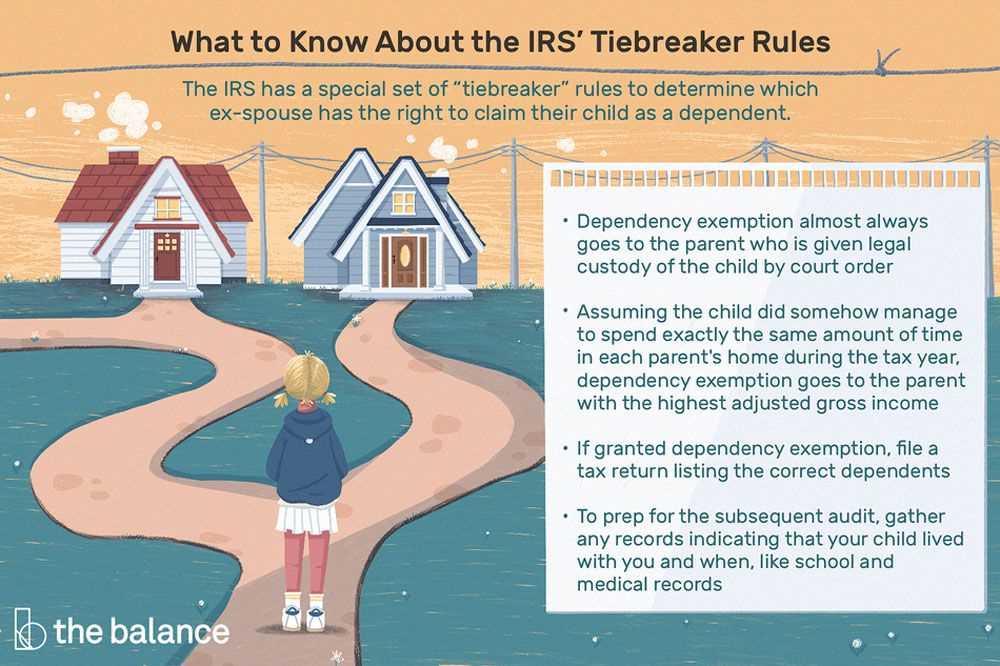

If I claim myself as a dependent, will it affect my parents’ ability to claim me as a dependent?

If you claim yourself as a dependent, it may affect your parents’ ability to claim you as a dependent. The IRS has specific rules regarding who can claim a dependent, and if you claim yourself, your parents may not be able to claim you. It is important to communicate with your parents and discuss the best course of action.

What are the benefits of claiming myself as a dependent?

There are several benefits to claiming yourself as a dependent. First, you may be eligible for certain tax credits and deductions. Additionally, claiming yourself as a dependent can help establish your financial independence and may have an impact on your eligibility for financial aid for college or other educational expenses.

What should I do if I am unsure whether I can claim myself as a dependent?

If you are unsure whether you can claim yourself as a dependent, it is best to consult with a tax professional or use tax software to determine your eligibility. They can help you navigate the rules and regulations and ensure that you make the best decision for your specific situation.

Can I claim myself as a dependent if I am over 18 years old?

No, if you are over 18 years old, you cannot claim yourself as a dependent. The rules for claiming dependents state that a person must be under the age of 19 or a full-time student under the age of 24 to be claimed as a dependent.

If I am married, can I still claim myself as a dependent?

No, if you are married, you cannot claim yourself as a dependent. The rules for claiming dependents state that a person cannot be married and be claimed as a dependent by someone else.

What are the benefits of claiming myself as a dependent?

There are several benefits of claiming yourself as a dependent. Firstly, you may be eligible for certain tax credits and deductions that can reduce your overall tax liability. Additionally, claiming yourself as a dependent may also make you eligible for certain government assistance programs or scholarships. However, it is important to consult with a tax professional to determine if claiming yourself as a dependent is the best option for your specific situation.

I am Lena N. Blackwell, a passionate writer and the author behind the content you find on vpequipments.in.

My work covers a range of topics including babies, culture, food, garden, holidays, pregnancy, tips, and travel. I strive to provide valuable insights and information to help parents, families, and individuals navigate through various aspects of life. My goal is to create content that is not only informative but also engaging and relatable, making your journey a little bit easier and more enjoyable.